While no one can completely forecast the future, there is every reason to believe that in Montreal’s real estate market, the next three quarters will see continued expansion and investment, possibly even at a faster pace.

In a new research, Zoocasa, an online realtor platform, offers four market projections following an incredible year marked by record-breaking sales and price increases of more than 20%.

1- Low housing supply is not a quick fix

In 2021, a lack of available homes for sale was a key factor in price increases. According to Zoocasa, there have only been four junctures in history when the national total months of inventory on the market fell below two months, all of which occurred in 2021.

It wasn’t because of declining demand that the market was calmer this year, but rather because there were fewer properties for sale. “To put it simply, we’re experiencing record-low inventory levels, with much more buyers in the market than there are houses to buy,” said Zoocasa CEO Lauren Haw.

“As buyers attempt to lock in a mortgage rate before next year’s projected rises, supply will be a crucial measure to watch moving into the new year – especially given that we may experience a hotter January and February than typical.” And this isn’t likely to change anytime soon, according to housing experts.

2- This time, mortgage rate rises might not be so awful

Interest rate rises, which the Banks have predicted will occur in mid-2022, are on the minds of both house purchasers and home owners. But how horrible is it going to be?

To find out, Zoocasa looked at the last time the Bank of Montreal raised interest rates, which was in 2018. There were three raises that year, and real estate activity slowed, with prices falling 4.9 percent and sales plunging 19 percent year over year. According to Zoocasa, the fall was mostly caused by the implementation of the stress test in that year, which reduced affordability for ordinary property purchasers by 20%.

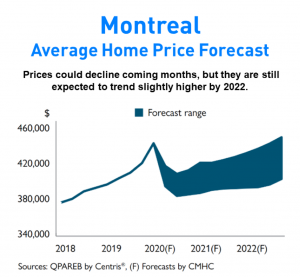

3- Home prices will continue to rise

In the coming year, the scramble to beat mortgage rate hikes, continued COVID limitations, and a lack of available properties are projected to drive prices upward. According to Zoocasa, if interest rates rise, it will be the more inexpensive residences, such as condominiums and townhouses that will witness the largest price gain. Royal LePage also anticipates that condo prices will climb by 12% in 2022, leading the city’s expansion.

4- The trend of virtual house searching isn’t going away anytime soon

Virtual home searching has remained popular, according to Zoocasa, even after COVID-19 limitations were loosened in the second half of the year and open houses were reinstated. Buyers “aren’t necessarily in a rush to go back to the old mode of buying properties” now that they have access to internet tours and real estate agents or can examine listings on real estate apps.

[instagram-feed]